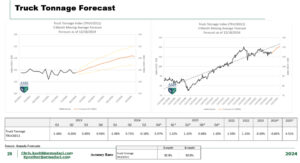

Logistics Manager’s Index (LMI) Stable

Those in the supply chain and logistics sector will be interested in the latest LMI which came in at 58.4, down just slightly from 58.9 in October. Importantly, this was the second fastest rate of expansion since September of 2022. The index has moved up for the past 12 months but remains just under the long-term average of 61.7 (the alltime high was 76.2 and the all-time low was 45.4). Transportation prices have inched up to 63.8, which is well above recent lows hit in mid-2023 of 27.9. Anyone purchasing transportation services needs to consider going into 2025 that shipping costs are going to go up as we move out of this previous cycle and into the next one. You can get the full report

NY Fed Consumer Expectations Surge

The latest data from the monthly Consumer Expectations Survey from the New York Fed showed a surge in expectations post-election. Here is how the Fed highlighted the three key points coming out of the monthly survey:

- “Year-ahead expectations about households’ financial situations improved considerably in November. The share of households expecting a better financial situation one year from now rose to its highest level since February 2020, while the share expecting a worse financial situation fell to its lowest level since May 2021.

- Median inflation expectations increased by 0.1 percentage point (ppt) at all three horizons in November; one-year-ahead inflation expectations increased to 3.0 percent; three-year-ahead inflation expectations increased to 2.6 percent; and five-year-ahead inflation expectations increased to 2.9 percent.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—ticked up by 0.5 ppt to 35.0 percent.”

The latest spending expectations data isn’t out yet, and that will tell much concerning spending on big-ticket items and housing.

Gasoline Prices Touch Lowest Levels Since 2021

Gas prices have come down to their lowest levels since May of 2021 largely because of lack of refinery maintenance and production disruptions this year, lower input prices with crude oil wholesale prices below $70, and inventory levels that are running at the midpoint of the 5-year average.

Many areas of the country have gasoline prices below the $3.00 mark, but national average prices are now $3.03 per gallon, 6.1% lower from levels a year ago. The chart below shows it in comparison to the historical range. Given some of the historical trends and the push by the incoming Trump Administration, gasoline prices are likely to remain below this $3.00 per gallon level.

US consumption has generally been running higher than the pre-pandemic years and is in-line with trends established in 2022/2023, but production is also higher.

- January–March: Consumption in early 2024 (8,238–8,887 thousand barrels per day) was lower than most pre-pandemic years but higher than the pandemic-impacted years of 2020 and 2021.

- April–June: By spring and early summer, consumption rose to 8,831–9,396 thousand barrels per day, nearing pre-pandemic averages but still slightly below the highs of 2016–2019.

- July–September: Mid-year consumption (9,297–8,994 thousand barrels per day) remained robust and comparable to recent years like 2022 and 2023.

The four-week average production as of November 29, 2024, was 9.699 million barrels per day. Production has been relatively stable in recent weeks, with the four-week averages ranging from 9.699 to 9.751 million barrels per day from November 15 to November 29. Compared to the same period last year (December 1, 2023), when production was 9.410 million barrels per day, current production levels are slightly higher.

Despite some shifting of gasoline demand as EV and hybrid adoption increases, it looks like the real factor here is the impact of higher production levels (from 9.4 million barrels a year ago to 9.7 million barrels this year) and cheaper oil input prices (down 6% Y/Y).