Labor Market Comes in Cool

The US labor report showed that the economy created about 114,000 jobs in July, well below expectations. The U-3 unemployment rate moved upward to 4.3% (up from 4.1% prior) and the U-6 hit 7.8% as mentioned (up from 7.4% in the last month).

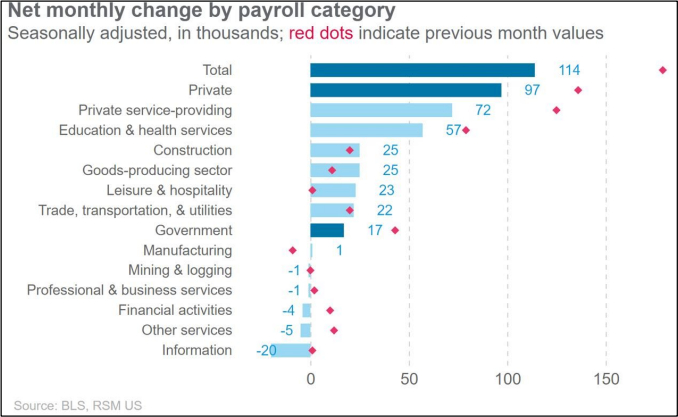

The chart at right shows the sectors and where job creation came from. The red dots are June data, blue bars are July levels. Less than half of the industries printed positive job growth, and government hiring accounted for nearly 18-19% of job gains.

The chart at right shows the sectors and where job creation came from. The red dots are June data, blue bars are July levels. Less than half of the industries printed positive job growth, and government hiring accounted for nearly 18-19% of job gains.

There aren’t many conclusions to take out of the data other than the notion that many sectors just aren’t hiring at rates that they were.

Aside from that being a “duh” statement, the most important facet is twofold. First, layoff activity is still not significant at a macro level. Layoffs can come in waves, and many executives may wait until they “see the whites of their peers’ eyes” before trimming headcount.

Second, slowing hiring (even though the US added 114,000 jobs this month) can still send negative signals through the workforce, and that can ripple through an economy. When companies start taking small actions to trim costs (fewer people attending conferences, removing job openings and not back-filling, etc.), it certainly sends a signal. Recently, discretionary stocks have been taking the hit more than staples. In other words, this would be the bleeding edge of a softening trend that might feed upon itself if it is allowed to run out of control.

This is just one set of datapoints and one report. But it does come as other surveys and reports are showing this “deceleration” (which is the new talking point).

The participation rate was little changed (which will typically push the unemployment rate higher), but layoff data is showing more than just data anomalies across the board. Temporary layoffs increased by 249,000 in July. The number of permanent jobs lost (permanent layoffs) was little changed in the month. Of course, moves like Intel’s recent announcement that it would lay off 15,000 would not have been included in the July survey.

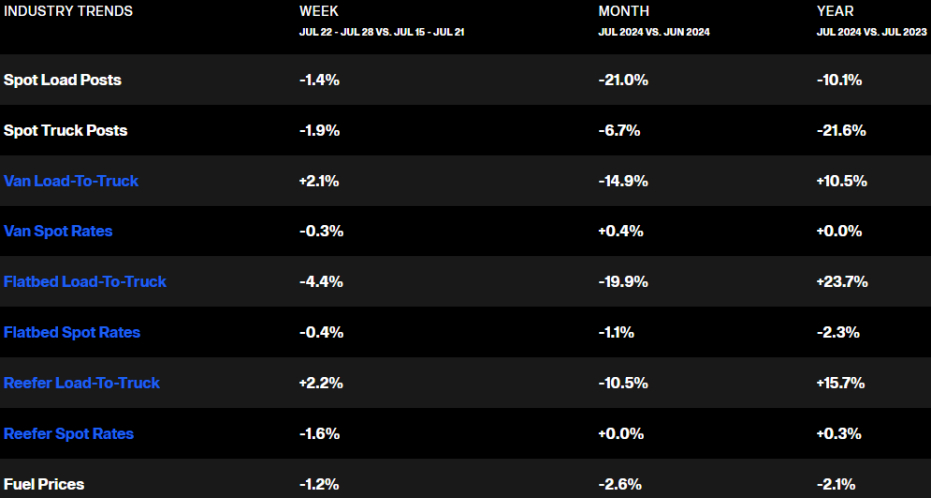

DAT Trendlines July Data Shows Slightly Warming Freight Market

The truckload spot market showed a 10% drop in demand for services year-over-year in July. Offsetting that was a 21.6% drop in capacity which led to a 10.5% increase in the number of loads looking for available trucks Y/Y.

Spot rates were unchanged in July year-over-year but were 0.4% higher month-over-month.

Fuel surcharges are also down 2.1%.

The industry continues to shed carriers as small firms exit the business, but excess capacity still exists on a broad basis. Only six states were reporting tight conditions in July (California, Nevada, Wyoming, Texas, Arkansas, and New Jersey). Most of the US had “average” capacity/demand environments, and five had markets that were oversupplied (Montana, North Dakota, Nebraska, Florida, and New Hampshire).

The national load-to-truck ratio according to DAT was just 3.97 loads for every available truck, in line with the past two years. That balance probably still favors shippers a bit, but in reality, the market is balanced headed into the peak season.

The Fed Doesn’t React to Market Drama

As the world digests what has been happening in the markets, there have been predictions regarding what the Fed will do. Many assume the Fed will respond to the turmoil in an urgent manner. Others are not convinced that a radical step will be required. What clues are available from listening to the Fed? The first takeaway is that the Fed does not equate market behavior with overall economic behavior. They are aware of the motivators that drove unemployment rates up, and these are not as threatening as many assumed. In fact, they welcome a little higher rate of joblessness as this may ease wage inflation threats. They have reiterated for months that inflation is not beaten and there are still reasons to keep rates high for a little longer. They are now pointing to the supply chain and the fact that container shipping has seen nearly a 300% increase. Transportation costs move through the entire economy quickly. There is a strong possibility that the Fed hawks will prevail and delay that interest rate reduction to December. This is more likely than an emergency cut or even a half-point reduction in September.