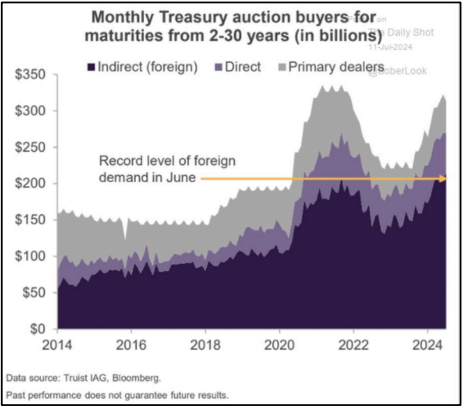

Foreign Demand Saving US Treasuries

This trend allows the Treasury Department to more affordably service US debt, and it keeps mortgage rates lower. Yield rates on the 10-year Treasury have fallen to 4.215%. If foreign investors keep chasing US debt, it would theoretically fall more if the Fed cuts interest rates in 2024. This will likely help the housing, automotive, and many other interest-bearing industries.

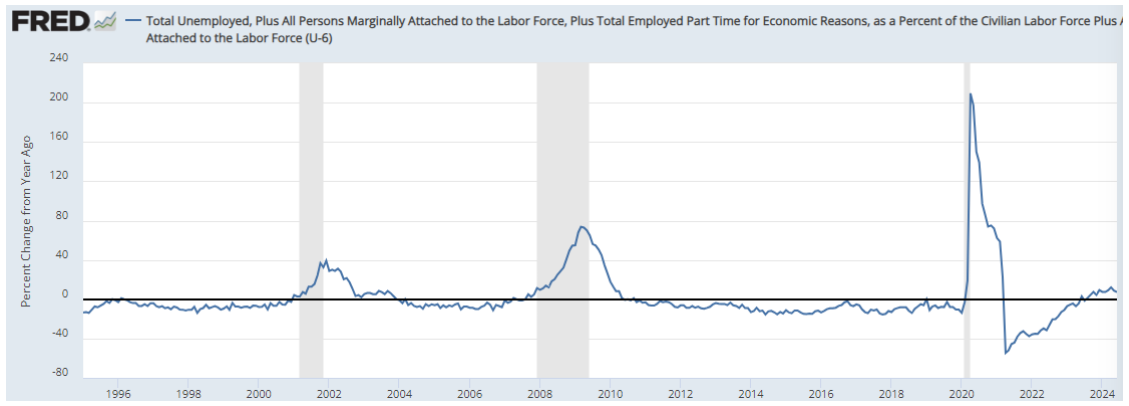

U-6 Shows “Sahm Rule” May Be in Play

The recent US labor report shows the potential for the Sahm rule to be in play. Overall, the labor report was what most expected, but there was some concern due to the strong revision in data from the past two months, shaving nearly 100,000 jobs created in the prior months.

In brief, the Sahm Rule is a recession indicator developed by former Federal Reserve economist Claudia Sahm that identifies the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months. That may be confusing, but the important fact is that these numbers have triggered that threshold.

The unemployment rate overall was relatively unchanged at 4.1%, the participation rate was unchanged at 62.6%, and the U-6 rate of unemployment was unchanged at 7.4%. The US created about 206,000 jobs in the month, in-line with expectations (prior to adjustments).

The government contributed 70,000 jobs, health care added 49,000, social assistance 34,000, and construction 27,000. Retail shed 9,000 jobs, as did professional and business services at -17,000. Other industries were unchanged or just slightly higher.

Wages were growing at a 3.9% rate, still outpacing inflation. This would theoretically give the Federal Reserve added strength in considering a rate cut in the September or December period.

The U-6 Rate is one of the best comprehensive measures of unemployment available, and it is currently running at 7.4%, unchanged over the past three months but 7.2% higher than last year. The U-6 has always predicted recession when it was higher year-over-year – and it is now in its 12th month of year-overyear increases. But the chart below shows that the increase is mild and not in the 30-50% range seen in prior recessions. So, could this be the Fed’s soft landing? Perhaps.

While the labor report was stable in June, it’s on rocky footing. There are hints of cracks in some of the data, and many are concerned that the situation could shift quickly into a contagion event in which companies react to news of layoffs and start layoffs of their own to get ahead of cost trimming. Job creation was generated heavily by Federal/State spending, and some sectors that would normally be hiring to support discretionary spending were flat or declining in the month.

80% of Consumers Expect to be the Same or Better Off Financially

The latest New York Fed survey on consumer sentiment showed that about 21% of households expect to be somewhat or much worse off in the next year. That is higher than in the decade prior to the pandemic (approximately 15%). But it is fairer to say that about 80% of households expect their financial situation to be the same or better a year from now. That attitude affects spending expectations, although many admit that they will wait for the Federal Reserve to take at least one rate cut before they engage in big ticket item purchases.

At the same time, households generally expect debt delinquency to increase. Roughly 12.3% of the population believes that it will not be able to make a minimum debt payment on one of their loans over the next three months. That is relatively unchanged from 12% last year but is higher than the 10.6% in 2019, a trend that is increasing over time.