The Baltimore Mess

There is little to be added to this discussion as it has been at the top of the media agenda for some time. Many of the initial rumors have been discarded, but there are still mysteries.

There is little to be added to this discussion as it has been at the top of the media agenda for some time. Many of the initial rumors have been discarded, but there are still mysteries.

It seems the ship was being steered by two tugboats, but they were unable to do much with a massive cargo ship that had lost power. There are no definitive reasons offered for the power loss, but it has been revealed that power losses at sea by cargo ships are common – this just proved to be an especially badlytimed loss.

The destruction of this key bridge will cripple Baltimore traffic for months, and the port itself will remain shut down for weeks. Authorities are now saying that the channel that the ship was using won’t reopen fully until the end of May due to difficulties removing the ship and bridge debris. The deaths of the workers on the bridge have triggered more investigations focused on protecting vulnerable construction workers.

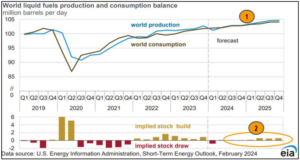

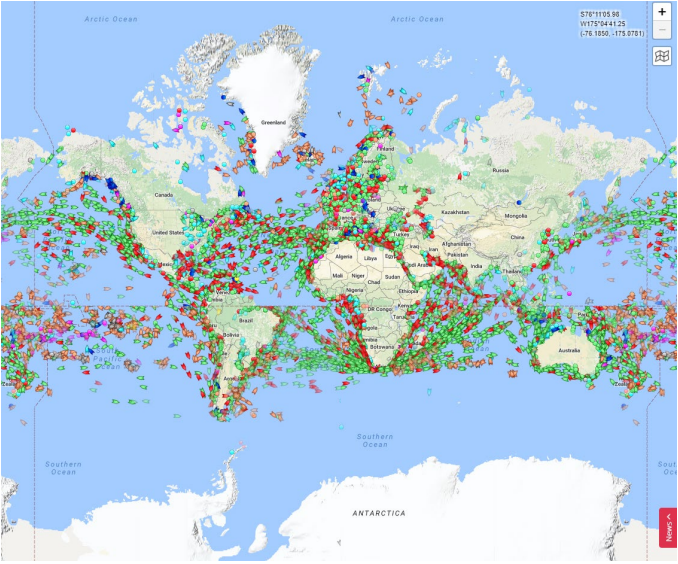

The impact on the overall supply chain is minimal, as the majority of ships have already rerouted to other ports. The big issue is that this is just the latest in a series of maritime-related supply chain issues, and that further reinforces the notion that Just-In-Time is a difficult concept to maintain. The world was already dealing with the Panama Canal drought, attacks in the Red Sea by the Iran-backed Houthi, pirates in the South China Sea, and chronic congestion in the world’s major ports. Then the world enters hurricane and typhoon season, and these storms always cause massive rerouting issues. The bottom line is that maritime shipping has been hit by several challenges at the same time, and these will take a toll. The map included shows just how complex and varied the maritime shipping routes are these days.

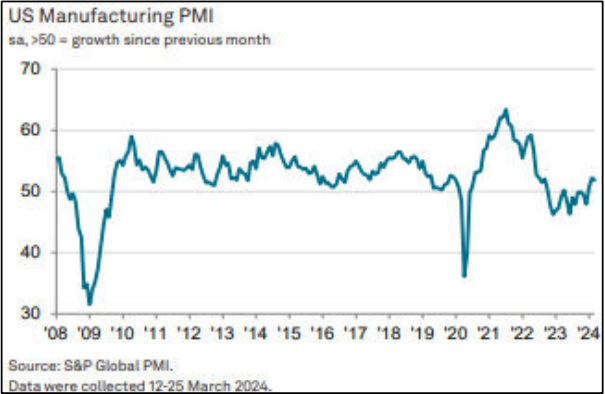

US Manufacturing “Stable” in March

The S&P Global Purchasing Manager’s Index for March slipped a bit from 52.2 in February to 51.9 in March. Output was stable, and manufacturers were generally optimistic, even going so far as to order new equipment and machinery to handle more demand.

- Hiring has slowed, but optimism about the future has many hanging onto current talent.

- Input prices are rising faster than expected, increasing selling prices. Those rose in March at their fastest pace in more than 11 months.

- New orders were “steady” and were rising for the third month in a row, albeit at a slower pace.

- Many are expanding investments in machinery and technology to improve productivity.

- Raw material demand is rising as a result, and global transportation and conflict risks are pushing those prices up on many items.

The bottom line is that manufacturers are optimistic about the future and believe that the second half of the year will bring solid demand across a wide variety of industries. They believe that inventories will remain balanced, and real economic growth will lead to real new order growth (instead of companies feasting off existing inventories as over the past 18 months). With the destocking trend over, the entire supply chain is activated – which is also why there are now higher prices for inputs and energy.

Will China Distort the Clean Energy Market?

The US, Europe, Japan, and many other developed nations are now facing a dilemma. What is of greater concern to them – protecting their domestic industrial community or promoting clean energy? Europe is already setting up new trade barriers to prohibit Chinese exports of EVs to the EU. These vehicles are cheaper to produce in China, and these imports will put European made products at a distinct disadvantage.

The US is moving in the same direction as it tries to protect US EV makers at the same time that it demands that consumers stop buying gas-powered vehicle. The US is also taking steps to protect the domestic production of solar panels and wind turbines. Treasury Secretary Janet Yellen has called on China to restrict exports of these clean energy products and has accused the Chinese of dumping. The process of contending with dumping is challenging as it is hard to prove.

It is not dumping if the Chinese really can produce more cheaply than the US or Europe, and of course, they can, given the lower wage structure in China. On the other hand, it is obvious that China subsidizes its producers heavily, and that makes it possible to sell a product for less than it actually cost to make it.