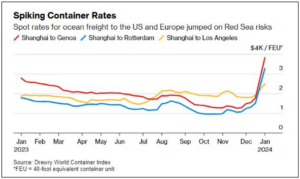

Container Rates Starting to Surge

Although they remain well below the spike seen in 2021 and 2022, maritime container rates are still surging of late. Supply chain managers that are touching shipping from afar need to prepare for the potential price spike that could come as a result of the situation in the Red Sea.

As mentioned at the front of today’s brief, it looks like the maritime sector is buckling in for the long haul. Maersk is now using words like “indefinite” to explain the shuttering of transits through the Red Sea. Thus far, an unwillingness of the US and allied governments to target sources of Houthi attacks from Yemen (fear of expanding the conflict if they strike Yemen directly – a visible act of war in their mind) has led them to remain bold and to continue to attempt to strike commercial and US assets in the region. US forces continue to play defense and knock down incoming munitions and anything in international waters that looks like a threat.

This won’t stop anytime soon. After attacks in Iran by ISIS, blame is still being placed on the US and Israel, and attacks from Yemen will continue to come.

The bottom line is that there have been no signs of a cooling of tensions for now. This is a day-by-day situation, and eventually, a bold firm may decide to try and make the transit through the Suez (creating an “express” service using the Suez), but the largest carriers are avoiding it for now.

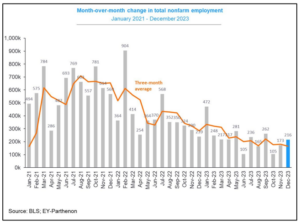

Jobs Report—Good or Bad?

The labor report came in hot enough in December that the stock market threw a little bit of a fit. Investors are concerned that if the economy were to remain too hot, the Fed would have to move on interest rates again. Savvy investors could see something completely different – a story that suggests that the economy is actually slowing nicely, despite a strong report.

The economy created 216,000 jobs in December, well ahead of expectations. In 9 of the last 10 months, the Fed has come in after a report release and has adjusted the figures downward. A revision to this data would likely knock it down into the 175,000 range (which would have matched other reports’ expectations).

The other factor that has folks nervous is the composition of job creation. The chart at right from Charles Schwab shows where the jobs were created. Education and health care are a bit seasonal with a lot of hiring for the flu season. Beyond that, government accounted for the second highest category, and many of those jobs can be temporary (or even possibly adding to the Federal debt – which worries some). In other words, is the country spending its way into a happy jobs market and creating a bigger problem on the backside?

That leaves construction, information, professional and business, manufacturing, and wholesale trade creating about 56,000 jobs. If those jobs in health care can hang on, that would be a good indicator of further quality job creation. But those sectors generating higher paying wages are softening, and maybe that’s the takeaway.

The wage figure was still pretty hot in December. That will help fuel inflation fears across the services sector and any industry that can’t be automated. It will also drive further speed and urgency into technology investments to try and offset that.

Is the Number of Growing Economies Shrinking ?

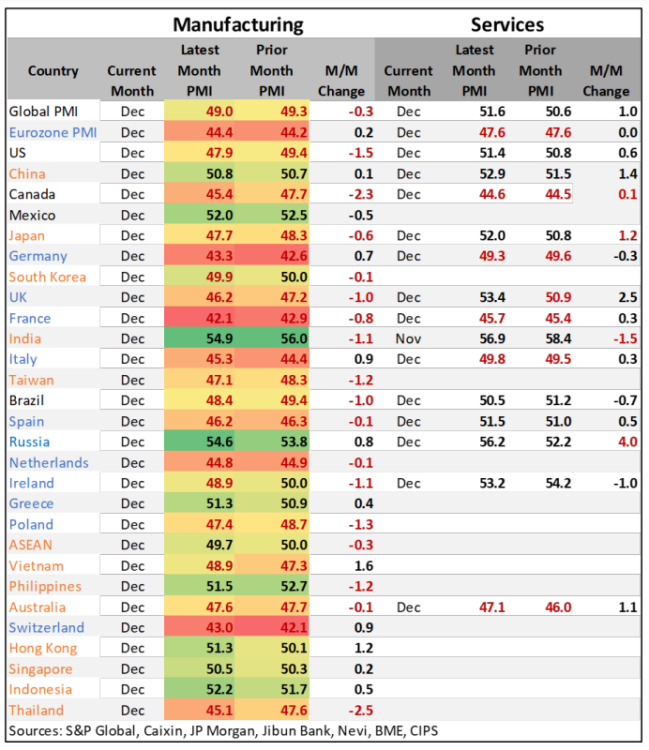

With only one report for December missing, all of the major manufacturing and services PMIs have been released, so one can now look across both reports for each country and see where the challenges are.

1. Canada (in deep trouble)

2. Eurozone (broadly)

3. Germany

4. France

5. Italy

6. Australia

These countries are having the same labor issues that we see in the United States, and because of a worker shortage, these countries are officially avoiding recession. But in a normal cycle, the PMIs in those regions would signal that those economies are in recession.

The bright spots would include:

1. India (fastest growing worldwide)

2. China

3. Russia (If one trusts the data – It could be the war machine, selling petroleum, grains, and metals to countries willing to purchase.) The Russian economy is far from the collapse many predicted.

The rest of the markets are mixed. They have manufacturing sectors that are struggling but largely have services sectors keeping their consumer-driven economies humming and staying out of recession.

New orders are still weaker across most sectors, but some of that will improve in February/March. Many firms have gotten inventories back in line, and conflict-driven sectors (defense equipment, munitions, supply chain materials, etc.) are in emergency demand. That economic engine alone will keep many economies pulling through the first half of the year and could be the stuff that lifts sectors and keeps economies in a soft landing scenario – for now. Consider firms that make everything from wire to chips, armor plating, and materials for ships, planes, tanks, etc. Defense spending has lifted many economies out of trouble in the past…but they may have to figure out how to pay for it later.