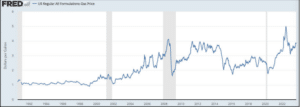

10 Year Treasury Touches 4.8%

The 10-Year US Treasury touched 4.8% in early October, the highest rate since March of 2007. Most people don’t pay attention to the 10-year bond, but it has a dramatic effect on borrowing costs for businesses and consumers alike.

Mortgages are tied to the 10-year Treasury, and mortgage rates continue to rise. The national average 30-year mortgage rate recently touched 7.5%, the highest rate since December 2000. If rates hover here, it may be the highest rate period since the time between the early 70’s and early 90’s. There is concern that if rates stay in this range for a while, it could have lasting effects on consumer spending.

The government also must worry about rising Treasury rates as it makes debt payments. In short, the government must pay more on its debt as rates rise. During the PIIGS nations sovereign debt crisis, there was discussion about what level of 10-year Treasury created an untenable situation for those countries and whether it would force them to default. The argument was that a 5% rate created economic growth sluggishness and a debt spiral difficult to come out of.

Where Are the Jobs Being Created?

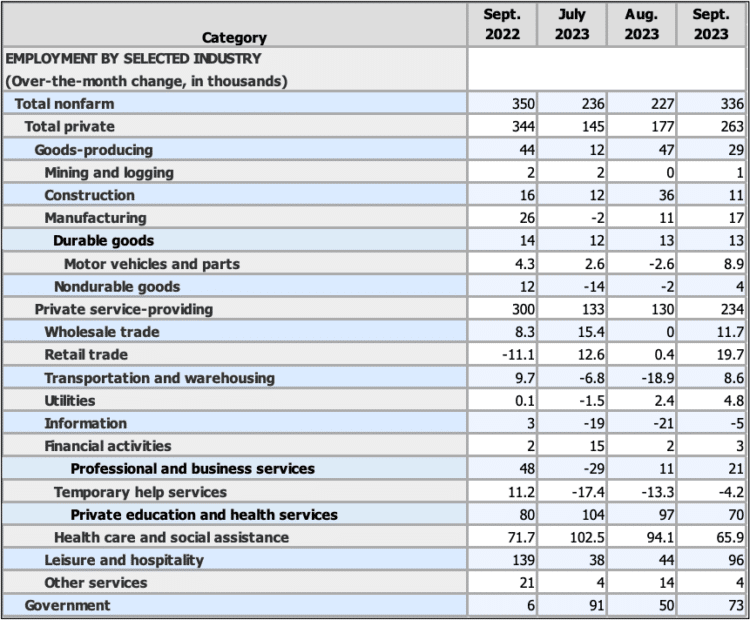

The recent report gave a good indication of where the economy was still creating jobs. It was generally widespread. There were a couple of sectors that obviously carried the weight of those gains, and in October, the labor report will show some impacts of labor strike activity.

First, private job creation saw about 263,000; government hiring created 73,000. The jobs were created mostly in the private services sector, and much of it was driven by health care at 65,900 and leisure and hospitality at 96,000. Wholesale and retail (getting ready for peak season) produced 31,000 combined. Two hundred thousand of the jobs created were in those categories and government.

The economy has also lost more than 692,000 full time jobs over the past 3 months. That could be indicative of pressure building in the economy. It does create some pressures if most of the jobs being created are parttime, minimum or near minimum wage jobs. That would continue to create pressures for discretionary spending. There was a note from a blue jean manufacturer saying that they were seeing consumers less willing to pay for jeans, because of the higher cost of those items.

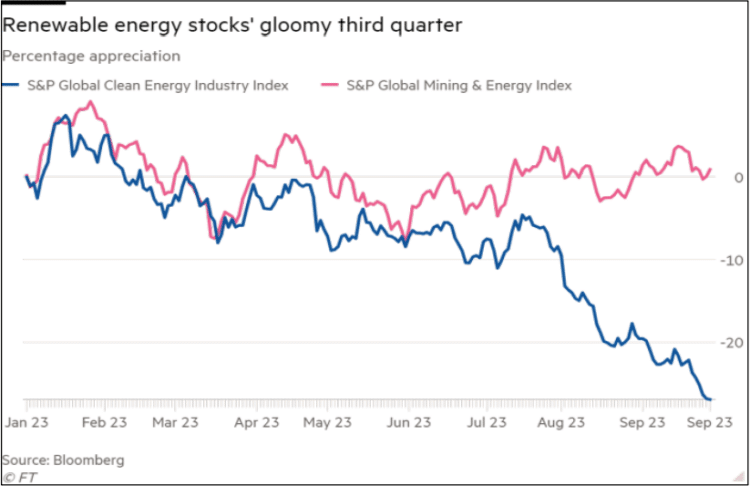

Renewable Energy Stocks Plunging as Interest Rates Rise

This is not good news for the clean energy enthusiasts, but there has always been a significant risk to this industry. It depends extremely heavily on investors with an eye to the future, and it depends heavily on subsidies and other government programs. The current mood in Congress has been obvious: there is a lot of opposition building to programs that cost a lot of money, and renewables have been at the top of the list (after areas such as Social Security, Medicare, and so on). The S&P Global Clean Energy Index has fallen by 20.2 percent over the last two months while the S&P Energy Index has gained by 6.0%. This latter index is heavily weighted towards gas and oil. These “green” stocks are headed for their worst performance since 2013.

The crux of the issue is rising interest rates. Companies in this sector regularly agree to long-term contracts that control the price at which they can sell power. As the rates of global inflation surged, these borrowing costs escalated rapidly, and the demand for renewables also surged. The subsidies actually made this situation worse as those receiving this handout were able to absorb the higher costs as the subsidies covered them. Others have not been so fortunate. The hardest hit have been in solar and wind. The Swedish developer – Vattenfall – has seen costs rise by 40%.

The bottom line is that the industry is not suited to a high interest rate environment or to inflation as a whole. It is based almost solely on government help, and that support is eroding fast as governments confront other budget realities. From the start of the push to renewables, this has been a weakness as the overall market still favors oil and gas.

The EIA also predicts that diesel prices will average $4.11 a gallon in 2023 ($4.17 in last month’s outlook). The outlook for 2024 currently shows diesel at $3.87 ($3.73 in the last update).