Inside Q1 GDP

There is still a tremendous amount of attention being paid to Q1 US GDP. Not to mention what happens in other countries, the underlying layers of the US economy are critical to understand if the US is in the recession camp. It seems like Wall Street is split on whether the US will visit at least a technical recession in the first half of this year (driven by stagflation) or if it is able to limp through it without a challenge.

The Atlanta Fed’s GDPNow estimate shows a macroeconomic contraction in GDP of as much as 2.4% in the latest reading. Even after adjusting for heavy gold imports (which swayed the import/export ratio and pulled negatively away from GDP), first quarter GDP would still be contracting at 0.3%. There will still be many adjustments to it in the coming weeks, but there’s a different story when one peels back the layers of the onion.

The subcomponent snapshot at right shows the various components. Importantly, the most important three to watch were still doing well:

- Consumer spending was still contributing 0.47 percentage points to GDP. Through the end of February, personal consumption expenditures were still growing at a 5.3% Y/Y rate. Normally, accounting for more than 70% of GDP, a strong consumer leads to a strong economy. And in this case, stable consumer spending with even moderate growth will help hold off recession.

- Nonresidential fixed investment was also strong in the early stages of Q1 – contributing more than 1.08 percentage points to GDP. At the end of Q4 (latest official data), investment grew at a 2.3% annual rate. Nonresidential construction alone grew at a 3.9% annual rate through the end of February. With some of the reshoring activity taking place, that should start to accelerate in the second half of 2025 into 2026 where it builds more momentum.

- Residential investment is still moving along as well. Easing mortgage rates would help if the administration can get the bond market under control. Easing government debt and controlling inflation will be critical if the bond market is going to stabilize, and both are still a concern for now with the tariff situation and uncertainties surrounding DOGE efforts (especially with Federal court challenges to some moves and uncertainty around the next Federal budget).

Bottom Line: The economy is struggling to find momentum under the weight of uncertainty, but the underpinnings of the economy continue to do well.

Consumer Expectations Fall in March

It shouldn’t surprise anyone that consumer expectations have fallen since the start of the tariff and trade war as well as government layoffs and budget trimming. One of the factors to watch is the impact on consumer expectations.

The New York Fed releases a comprehensive study that shows consumer expectations for the next six months ahead, and it was a bit shaken. Keep in mind that consumer expectations can change quickly (far faster than corporate expectations). Here are the key highlights from the survey:

- The median expected growth in household income decreased by 0.3 to 2.8% in March, falling below its 12-month trailing average of 3.0%. The decline was most pronounced for respondents with (at most) a high school degree and for those with annual household incomes under $50,000.

- Median household spending growth expectations declined by 0.1 percentage point to 4.9%. This was still a stable spending level, but the deceleration is something to keep top-of-mind.

- Perceptions of credit access compared to a year ago showed a larger share of households reporting it is harder to get credit. Expectations for future credit availability also deteriorated, with a larger share of respondents expecting it will be harder to obtain credit in the year ahead. This could impact everything from auto sales to other types of short-term debt; many consumers aren’t even trying to get credit for fear that they might get declined for it.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 1.0 percentage point to 13.6%, remaining slightly above the 12-month trailing average of 13.4%. This should be good for credit markets overall.

- The median expectation regarding a year-ahead change in taxes at the current income level decreased by 0.2 percentage point to 3.2%.

- Median year-ahead expected growth in government debt decreased by 0.4 percentage point to 4.6%, the lowest reading of the series since its start in June 2013. It seems like consumers are going along with the items that the administration is trying for now. They seem to be more concerned about the short-term impacts from those changes (such as reducing government debt).

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.7 percentage point to 26.1%.

- Perceptions about households’ current financial situations compared to a year ago deteriorated slightly, with a larger share of households reporting a worse financial situation compared to a year ago. Year-ahead expectations about households’ financial situations also deteriorated in March. The share of households expecting a worse financial situation one year from now rose to 30.0%, the highest level since October 2023.

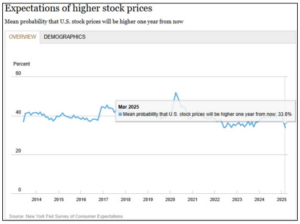

- The mean perceived probability that U.S. stock prices will be higher 12 months from now dropped by 3.2 percentage points to 33.8%, the lowest level since June 2022.

The bottom line is that 1) consumers are spooked enough that the current situation is having a material impact on their consumption activity and applying for loans, spending on durables, etc. but 2) they remain somewhat hopeful that spending expectations for the future will improve.