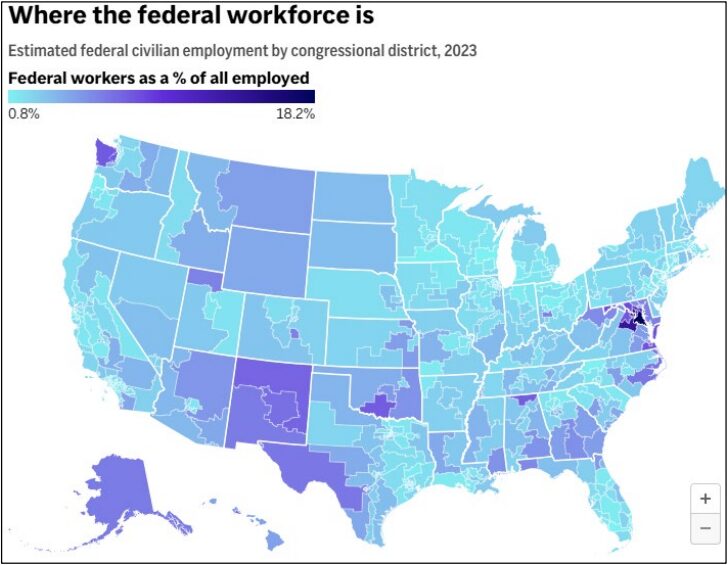

Local Impacts from Fed Worker Layoffs

Estimates That $31.2 Billion In Early Inbound Inventory Could Be Wrong

There was a lot of speculation on the volume of inventory that might have been inbounded early in December and January to get ahead of tariffs and (at the time) strike threats on the East and Gulf Coast Ports. New data sheds some light on what might have been the dollar total that got inbounded early.

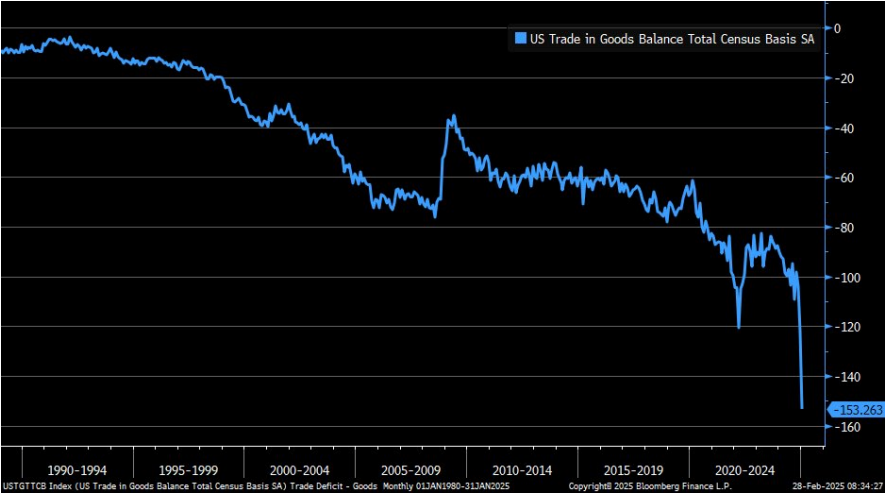

The chart below shows the trade balance in goods for the US, and of course the deficit grew in January. It came in at $153.3 billion in January, much larger than the $122.1 billion in December and well above expectations for ~116.6 billion.

At first blush, it looks like there could have been more than $31.2 billion in extra inbound inventory between December and January (which is a big volume if that were entirely consumer goods trying to beat tariffs). But there is more to the story.

Real US exports of goods were down $21.5 billion between December and January. That might suggest that the real impact may have been less than $10 billion, and a strong US dollar could have been a big factor pushing firms to inbound materials early.

This is only important from one perspective; everyone wants to know how much inventory was “pulled forward” in January because that could affect volumes and economic activity in Q2.

There is a bunch of noise in the data no matter how one looks at it. Although there’s no February data yet, the ISM showed that most manufacturers were underweight on inventories and their customers were also underweight through January. So, at this stage, it looks like the “pulled forward” concern may not be as blown out as expected – and it certainly flies in contrast to the scary charts like the one above.

China Devalues Yuan to Combat Tariffs

The People’s Bank of China (PBOC) has widened the yuan’s daily trading band to ±3% (from ±2% in 2024), enabling controlled depreciation. State-owned banks are strategically selling USD reserves to prevent rapid yuan declines while allowing gradual weakening.

The USD/CNY rate reached 7.40 in February 2025, a 4.1% depreciation since November 2024. This mirrors China’s 2018 playbook, where a 10% yuan devaluation offset 25% U.S. tariffs on $250B of Chinese goods.

Just to put some emphasis on this and to highlight the implication: a 7.40 USD/CNY rate negates 60–70% of the proposed 10% universal tariff (effective tariff: 3–4%).

Yuan depreciation boosted China’s Q4 2024 exports by 8.3% YoY despite tariffs, with electronics and EVs gaining market share in ASEAN and Latin America.

But here is the problem: because of the devaluation of the yuan, capital flight concerns accelerated with $68B in nonresident outflows recorded in Q4 2024—the highest since 2015’s “mini devaluation crisis”.

Mexico, for comparison, is different. The peso fell 9.2% against the USD in the 10 days following the February 5 tariff announcement (MXN 19.25 → 21.05). Banxico has refrained from aggressive rate hikes, accepting weaker FX to support exporters. And Maquiladoras now price 45% of exports in USD (vs. 28% in 2023), insulating against further peso volatility.

But there’s a catch: Mexico’s 25% tariff exposure ($294B in US-bound exports) limits devaluation benefits. A 10% peso drop only offsets ~30% of tariff costs due to import-heavy production (60% of inputs are foreign-sourced).

Other countries have largely held off on aggressive action, but Vietnam did also take some pre-emptive actions. The State Bank of Vietnam devalued the dong by 3.4% in January 2025—the largest cut since 2011—to protect electronics exports facing U.S. “circumvention” tariffs.

The US could also retaliate. Besides labeling China a currency manipulator and triggering punitive measures under Section 301, there are proposals reportedly on the table that would impose additional tariffs on countries that go through higher than 3% real depreciation in their currency.

Starting with the application of tariffs this week, the net effective tariff rate is going to become the biggest source of conversation moving forward, as will exceptions to tariffs product-by-product.