Update on Economic Outlook

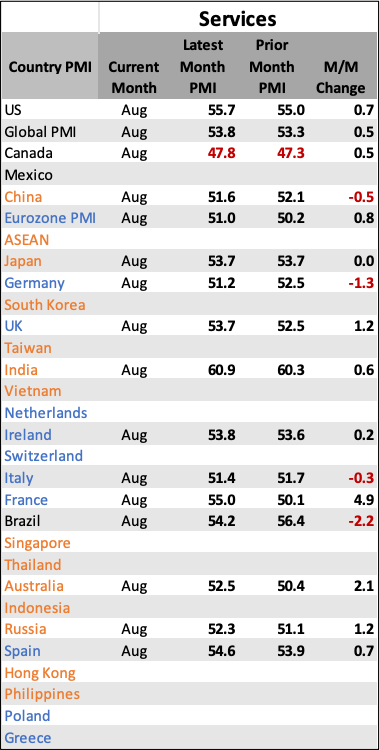

First, it is important to remember that the services sector in most developed economies can account for more than 60-70% of GDP. It covers everything from retail and health care to professional services, construction, etc. In many ways, the services sector PMI carries much more weight on macroeconomic outlooks than do the manufacturing reports.

Second, the US Services PMI readings came in slightly higher than last month and were firmly expanding (over 50). This reinforces trends in which the services side of the economy is growing faster than other sectors – and it continues to be stable.

Third, Canada was the only market that was negative and contracting. The Canada services index is the newest services PMI, and there could be some adjustments that still need to be made in the index, or the survey distribution will be adjusted by S&P Global to be more representative of the broader economy. It seems odd that it would be the only country in the world in contraction (and a manufacturing sector in contraction would normally signal that the broader economy was in recession).

There is a lot of discussion by analysts that the global economy is in recession or headed for it. Four of the countries monitored (out of 16) were decelerating month-over-month, and only one as mentioned was in contraction, hardly a global recession flag. Even Germany, which has a manufacturing sector in recession, was still seeing strength in its services sector.

Everything, from commodities to stocks, executive sentiment to consumer sentiment, is hanging on headlines right now, and many of the headlines about the global economy are negative. The real data behind the scenes shows a resilient global economic condition, even if pockets are sluggish.

Important to Continue to Monitor Maritime Rates

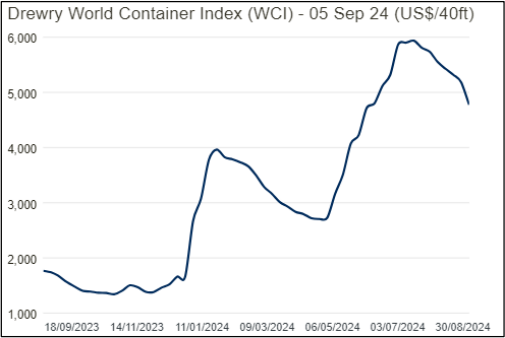

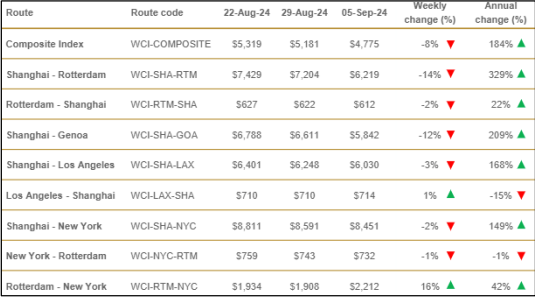

A continuing theme in the global supply chain sector is a surge in maritime rates. The Red Sea situation continues to keep prices elevated, so here is an update on current rates.

Rates on a global basis are still trending at about $4,775 a container. Drewry reported that current rates are still 236% higher than the pre-pandemic average rate of $1,420.

Asia to US West Coast is more elevated at 168% higher because of East Coast labor strike risk building toward the end of September. The national contract between the ILA and USMX deadline is September 30th, and the parties are currently far apart. The contract affects ports ranging from Maine to Texas, and more than 24,000 workers could be impacted.

On a macro basis, this increase in maritime transportation has elevated inflation slightly but not as much as one would expect. It may have inflation rates elevated by 1 to 2 tenths of a percent higher than if the situation in the Red Sea were not taking place, but it is not without impact. More importantly, there have now been dozens of commercial ships hit and threatened by Houthi Rebels, and disruptions in using the Suez Canal have stripped as much as 20-25% of total capacity out of the global maritime sector. This situation is not expected to end for the next six months or more, so those trying to build budgets for 2025 need to factor in higher rates for transportation as a result.

Mediocre Jobs Report

This was a report that pleased nobody. The pessimists wanted to see a major drop in job growth and a spike in unemployment as this would justify their assertion that the US was teetering on the precipice of economic collapse. The optimists were hoping there would be limited job shrinkage and a justification for insisting this was a “soft landing.” Neither camp got what it wanted. The prediction was for 165,000 new jobs, and there were 142,000 – a miss but not a big one. The unemployment rate improved from 4.3% to 4.2%. What does all this mean? In a sense, this indicated more stability than expected although the markets went into their usual swoon. The labor market is clearly weaker than it was a few months ago, and there are fewer jobs on offer, but nothing suggests an imminent mass loss of jobs – at least not enough to trigger a reaction from an overly cautious consumer.