Interesting Observation: Shipping Rates and Inflation

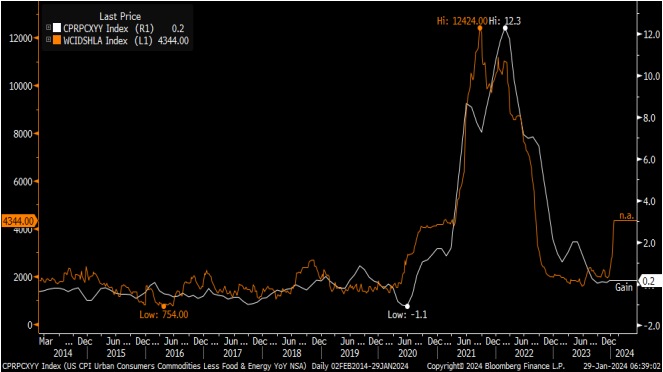

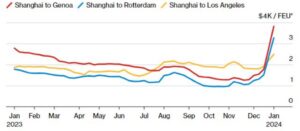

Peter Boockvar put a note out recently on the relationship between shipping rates (primarily maritime) and the Consumer Price Index (CPI) and found that the two move very closely together. Of course, like with other data sources, there can be a difference between correlation and causation. There is certainly a correlation in this case, and one could intuitively assume that there is also causation. The cost of shipping containers in key trade lanes connecting Asia with the rest of the world has surged, with some lanes up more than 160% year-over-year. Will that rise in rates affect the Fed? It’s still inflation, and they have to use whatever levers they have to get inflation down from many different sources, even if they can’t affect this one directly.

Home Prices by Market

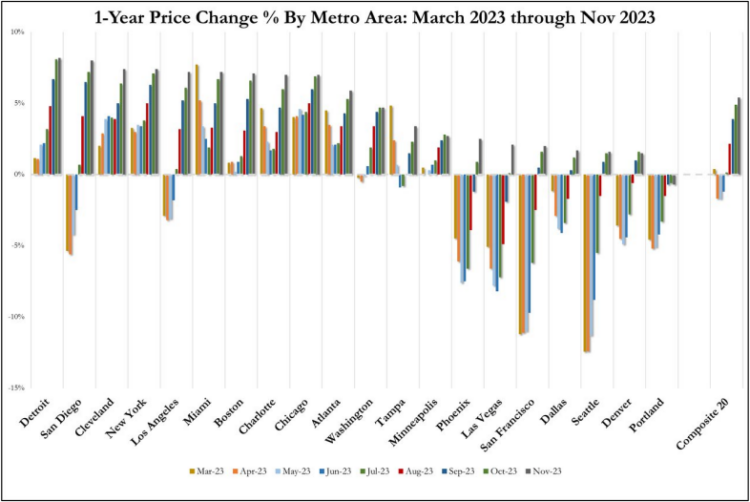

The Case-Shiller US National Home Price Index came in 5.2% stronger through November and was up 0.2% month-over-month. Housing starts for private single-family residences touched on their second highest levels since the 2005-2006 housing boom (the period from 2020-2022 was also higher) at 1.027 million units a year (vs. the December 2020 recent peak of 1.311 million).

Inventories are mixed. Looking at the total months of new home supply, the current reading shows it at nearly 9 months of inventory on hand; a balanced market is closer to 6 months. But when we break out existing single-family inventories from the National Association of Realtors (NAR), it is showing about 870,000, which is not far off of the low levels from a year ago. So, there is some discrepancy in the data.

The chart below shows the price changes by market. Of course, geography is the most important factor in the housing market. Portland was the only city really down for the year. All other markets were essentially still seeing price appreciation over the past few months. Note the increases in prices, however, and where some of the best growth is. Those locations seem to buck some of the migration trends in the US. And again, some of this change will be driven by inventory differences, the rate of building in those markets over the past year, etc. Some markets that have not attracted a lot of builder attention likely have tighter inventories, and prices will rise for those sellers that have a lot of buyer demand.

Clearly, more information and data will be needed to really understand what is happening in these markets.

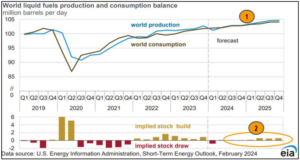

OECD Report Predicts Low Inflation and Rate Cuts

The central banks have not been eager to declare victory over inflation. The reasons for this reluctance include worry about wage hikes, the volatility of the energy market, as well as other factors. That said, the rate of inflation has fallen dramatically in the last year, and the OECD expects the US to see rates as low as 2.0% or 2.5% for the year. The ECB will see average rates between 2.5% and 2.7% with the UK sporting the highest price levels at around 2.8%. Given that most of the central banks still have their inflation goals set at 2.0% to 2.5%, it would seem the battle has been won. This leads the OECD to assume that interest rate cuts will happen by the middle of the year at the latest, and it would seem that the US will lead the way as the Fed has asserted that three cuts of at least a quarter point would be appropriate. As encouraging as this may be, it is important to note the cautionary statements around the energy and food sectors as these have been driving down inflation numbers.