Goldman Warns of Tight Oil Supplies in 2024

With global demand for oil weaker, there is enough supply that inventories are building, and prices are coming down slightly. But with only 1.2% spare capacity worldwide, a slight increase in demand would create a price rebound. Goldman Sachs put out a note recently reiterating their long-term view that oil will be short by 2024.

Wall Street investment firms (have sometimes) had a reason to push the outlook for commodities up or down, but typically, it always has to come with supporting analysis that one can either agree or disagree with. With that in mind, Goldman said in its note that $100 oil is feasible in the next 12 months and that 2024 is a period in which the greatest pressure could develop. Other firms are also in the $100-$150 per barrel club, and there is almost an equal amount in the $50 per barrel crowd. Predictions are all over the place.

Among the primary reasons why they believe prices will go up include the following:

- Restarting consumption in China and improving economic conditions in Europe post-winter;

- Easing of US economic pressure at some point in 2023;

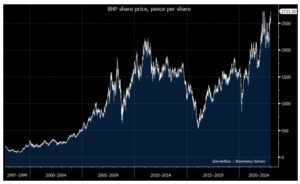

- Slower US production of oil and missing peaks set prior to the pandemic – and a continuation of slowing investment in new production;

- OPEC+ slowing investment;

- South American production starting to face pressure by progressive administrations hoping to cut output of fossil fuels;

- Any weakening of the dollar pushing oil prices higher.

Whether these conditions can outweigh demand destruction that could come as a result of global slowing is another story. China reopening will create some increases, but that won’t be enough to make up for a drop in demand in 18 other developed or developing countries currently seeing contraction of macroeconomic activity.

Commodities Mixed, But Problems Ahead

Commodities Mixed, But Problems Ahead

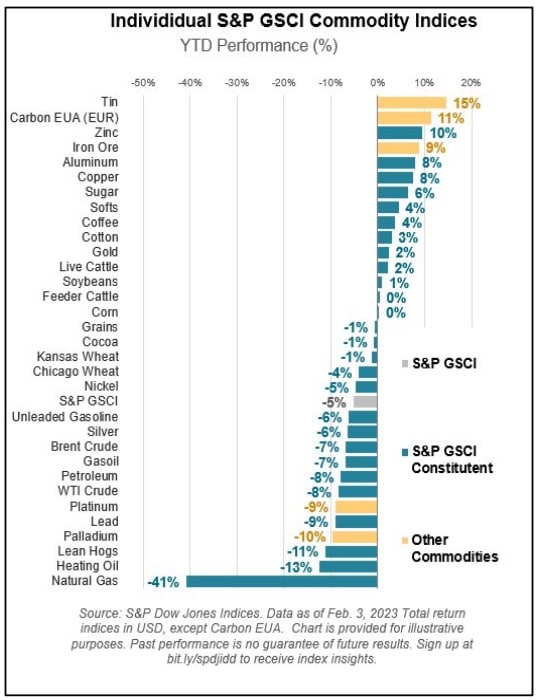

The S&P GSCI commodities index shows how global prices for certain commodity classes have changed recently. The important change is the inching up of certain raw material commodities prices.

For instance, reports suggest that the US will impose a 200% tariff on Russian aluminum imports soon. Russia is the world’s second largest producer and has about 6% of global production overall. About 10% of Russian supplies hit the US, and Kitco is still showing aluminum inventories at multi-decade lows. The chart shows that S&P GSCI aluminum index is up 8% recently – at a time when the US is arguably going into a mild recession and 19 countries have manufacturing sectors in contraction. What happens when this turns around and manufacturing activity increases?

Kitco was showing copper, zinc, tin, and other items high on the chart showing low inventories (again, many of them at multi-decade lows). Again, unless the world can recover some of the production lost during the pandemic, the world will suffer when all markets resume pre-pandemic consumption levels.